The Moscow Financial Forum, held on September 8, 2022 at the Russian capital, also featured a special session titled “Diamonds as an Investment Tool”.

According to Rough & Polished, the session was attended by “the leadership of the Ministry of Finance of the Russian Federation, the Bank of Russia, ALROSA and leading commercial banks,” and focused on diamonds as a venue for investment in a time when “deposits in dollars and euros are no longer an asset to be invested in […]”, according to Alexei Moiseev, Deputy Minister of Finance of the Russian Federation.

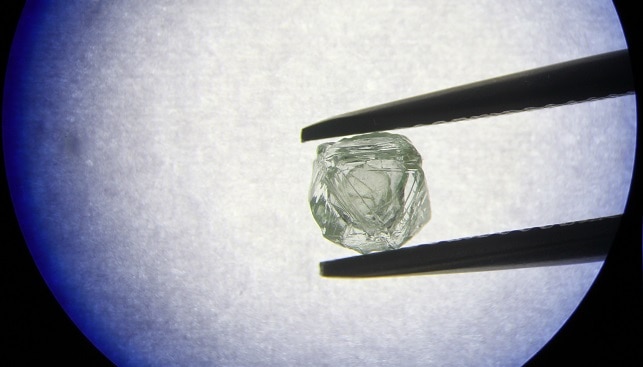

Moiseev continued: “[…] With the abolition of VAT on their sale to individuals in banks, this opens up new opportunities for creating an effective financial asset for private investors. Diamonds are attractive due to their capital intensity, weak correlation with other financial assets, and pegging to global prices. Their investment potential is due to the depletion of the world’s diamond reserves since there are no new deposits with an efficient economy. Along with precious metals, diamonds are traditionally used for long-term investment. The diamond investment market is promising for Russia, and it needs to be developed with the support of the banking community.”

According to the report, Alrosa currently offers two products: especially large stones of exclusive colors with an entry threshold equivalent to $50,000; and a “diamond basket” – a set of diamonds weighing 0.3 carats or more with a total value of $25,000 or more, having a standardized price per carat and the possibility of resale to Alrosa. The purchase is made in rubles.