Anglo-American has published its mining results for the first half of 2019, including the performance of its diamond miner De Beers. According to De Beers, Underlying EBITDA (earnings before interest, taxes, depreciation, and amortization) decreased by 27% to $518 million.

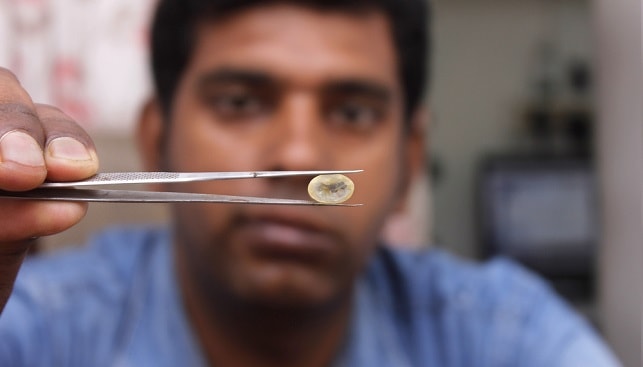

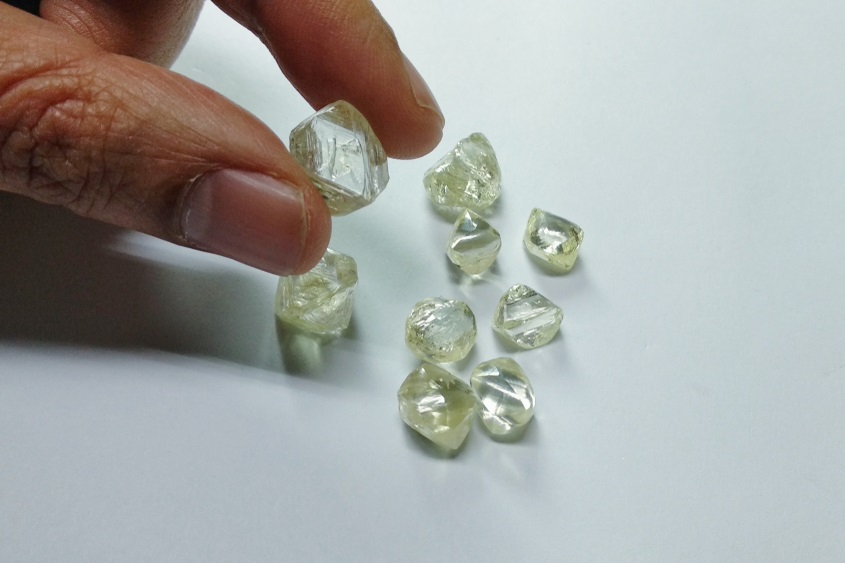

De Beers attributed the sharp drop to “challenging midstream trading environment and slowing consumer demand growth, which has resulted in a decrease in the rough diamond price index and realised price, as well as lower margins in the trading business”. Rough diamond sales fell 21% to $2.3 billion. The average realised rough diamond price fell 7% to $151 per carat, “driven by the reduction in the average rough diamond price index and a change in the sales mix in response to weaker conditions”. Rough diamond production decreased 11% to 15.6 million carats.

As for De Beers Jewellers, the company said that overall sales performance “has been adversely affected, primarily in high jewellery, by global trade tensions”.

De Beers added that global demand for rough diamonds was subdued in the first half. In the US, results were affected by stock market volatility, US-China trade tensions, retail store closures and destocking, while demand outside the US continued to be impacted by US-China trade tensions, the Hong-Kong protests and a stronger US dollar. The miner expressed optimism for the longer term, saying: “Underlying GDP growth remains supportive of consumer demand growth and is expected to bring midstream and retailer stocks back to more normalised levels as we move into 2020 […]”.