Anglo American has held its Annual General Meeting for shareholders in London on April 24. Sir John Parker, Chairman of Anglo American, began by speaking about the “continuing slow global economic recovery” in 2016, then went on to speak about global trends expected in 2017.

Parker said that concerning demand, “the fortunes of the mining industry will inevitably continue to be influenced by developments in China”, while “continuing slow growth” in the rest of the world as well as “ the new and protectionist-leaning US administration […] may be a drag anchor on the global economy for some time to come”.

Mark Cutifani, Chief Executive of Anglo American, commented that the company “delivered free cash flow of $2.6 billion, well above our target and our net debt was reduced to $8.5 billion – well below the $10 billion that was our target”. He added that Anglo American “sold or closed 27 assets, reducing the portfolio to 41”.

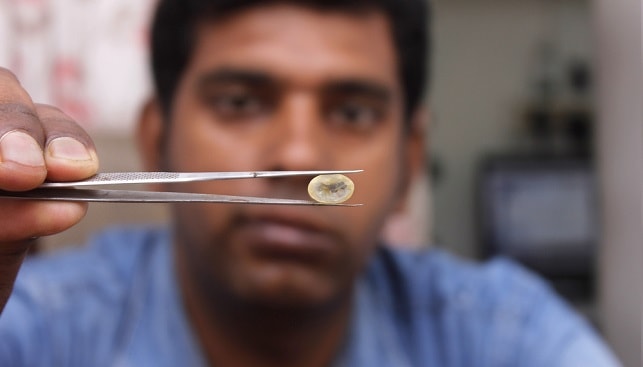

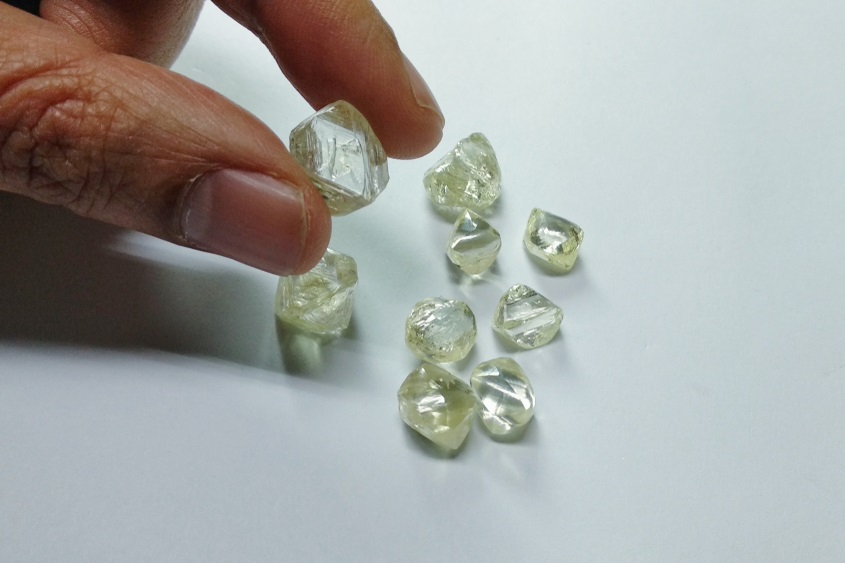

Concerning diamonds, Cutifani said: “We have a business that is global in scope and scale. While each asset may not be Tier 1 in its own right, the aggregation of assets under the De Beers business adds breadth and value to our customer product offering”.