Australian mining giant BHP has abandoned its $49 billion takeover bid for Anglo American, IDEX Online reports. The sale of De Beers, Anglo’s struggling diamond division, is expected to proceed as planned.

After a day of intense negotiations on Wednesday, May 29, Anglo rejected BHP’s request for an extension beyond the 16:00 GMT deadline to finalize the deal. BHP claimed Anglo denied access to “key information” during negotiations “despite numerous requests.” Anglo, citing extensive discussions, maintained that the deal posed a significant risk of failing South African regulatory approval.

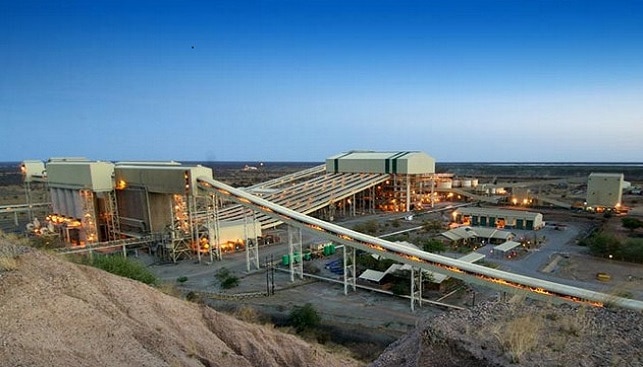

Earlier in May, Anglo confirmed it was looking to sell De Beers. Anglo also plans to divest its platinum, nickel, and steelmaking coal operations to focus on more profitable ventures like copper.

De Beers saw a 36% drop in sales last year, down to $3.63 billion, with per carat prices falling 25% to $147, resulting in a loss in the second half of 2023. The company has reduced its production guidance for this year by 10%, expecting output to be around 26-29 million carats, down from an initial forecast of 29-32 million carats.