By Olivia Quiniquini, Bernardette Sto. Domingo

The Covid-19 global pandemic may arguably be the international gem and jewellery industry’s biggest challenge to date. Since emerging late last year, the virus has spread like wildfire across the world, paying no heed to boundaries of geography, class and race.

In late April, the global toll stood at over 3 million cases and more than 200,000 deaths, with almost every country in the world making an appearance in the tally of infections. The fight against this global threat has drastically altered people’s lives and thus industries at large. Global consumption, particularly for luxury items such as jewellery, has fallen as people hunker down at home amid virus-containment efforts.

From lockdowns and social distancing regulations to remote work procedures and digital tools, life in the time of Covid-19 is forcing businesses to rethink priorities, operations and strategies. Cost-cutting measures are in full swing, with many jewellery firms adopting temporary store and office closures, work-from-home arrangements, salary cuts, rent restructuring and shorter work weeks to stay afloat – essentially exhausting all possible avenues before considering closures and retrenchment.

Yoram Dvash, acting president of the World Federation of Diamond Bourses (WFDB), said the impact of the coronavirus pandemic far outweighs that of any other challenge the international gem and jewellery industry has faced in the last few decades, including the various financial crises and the SARS outbreak in 2003.

“The Covid-19 outbreak wiped out business in one fell swoop – the industry went from 100 to almost zero. Over the course of a week or so, everything ground to a halt. Nobody is selling; nobody is buying. Manufacturing has shut down; consumer sentiment is extremely low. Deliveries are hampered by travel restrictions and border closures, while wire transfers to and from certain countries have been suspended,” Dvash revealed. “Payments are not coming in because clients have shuttered their business for now or allocating funds to more immediate needs such as rents and payrolls. But the international jewellery industry is being patient and bearing it because we are all in the same boat.”

Trade fairs and industry events were among the first casualties, given travel restrictions and social distancing regulations to contain the spread of the coronavirus. Losing these all-important business platforms have dealt a severe blow to many sectors. With physical containment of the virus being the order of the day, the business focus has shifted to the digital space. Online platforms, virtual fairs, educational and market webinars, and sustained digital marketing and communications have emerged to help keep businesses going during the downturn.

DIAMONDS

Virus-led disruptions have significantly impacted the diamond trade, causing both a substantial drop in business due to supply chain challenges and a momentous shift in business paradigms.

Diamond miners Alrosa and De Beers have adjusted their business schedules in light of travel restrictions and market circumstances. Both allowed their clients to defer 100 per cent of their April purchase allocations to later in the year.

Alrosa saw its March 2020 sales of rough and polished diamonds fall nearly 60 per cent year-on-year to US$152.8 million. Overall sales from January to March 2020 came up to US$904.2 million. Difficulties also emerged at the manufacturing and export levels. WFDB’s Dvash, who is also president of the Israel Diamond Exchange, estimated that Israeli diamond exports fell by 75 per cent from mid-March to late-April. This comes on the heels of a 28 per cent decline in Israel’s polished diamond exports in 2019 to US$4.9 billion due to the US-China trade war and the protests in Hong Kong.

Preliminary figures from the Antwerp World Diamond Centre (AWDC) showed that Belgium’s diamond business in the first three weeks of April fell to around 4 per cent of its trade levels in the same period last year. Exports of polished diamonds in the first quarter dropped 45 per cent to around US$1.7 billion, compared to US$3.1 billion in the same period last year.

The coronavirus pandemic is indeed exacting a heavy toll on the diamond sector, said Lawrence Ma, president of the Diamond Federation of Hong Kong, China (DFHK). Top Hong Kong retailers are reporting sales declines of 50 to 60 per cent for March 2020, while the wholesale trade is down by 80 to 90 per cent. Production has stopped in India and other manufacturing centres that are on lockdown.

Ma stated, “The impact of the virus is quite significant. We need to assess the situation every two months and see how things unfold. Major concerns include cash flow, the supply of goods, surpluses, liquidity and bank regulations.”

Digital impact

With business dwindling from the virus-induced slump, the diamond industry opened the online floodgates to stimulate the market, with various business models and initiatives making their debut over the last few months.

Alrosa held a digital tender for special-sized rough diamonds of over 10.8 carats from March 23 and April 6. For their part, the Israel Diamond Institute and AWDC collaborated on a five-day Online Diamond Trade Show at the end of March, which Dvash described as a good start in exploring new business models as well as channels for growth in the online space.

The Covid-19 global outbreak also set the backdrop for systemic changes, following trade furore over Rapaport’s diamond price list of March 20, 2020, which posted declines of 5 per cent to 8 per cent in the prices of polished diamonds. A significant number of diamond dealers either pulled their stock from Rapnet, continued trading using prices from the March 6, 2020 list or moved to other online trading platforms.

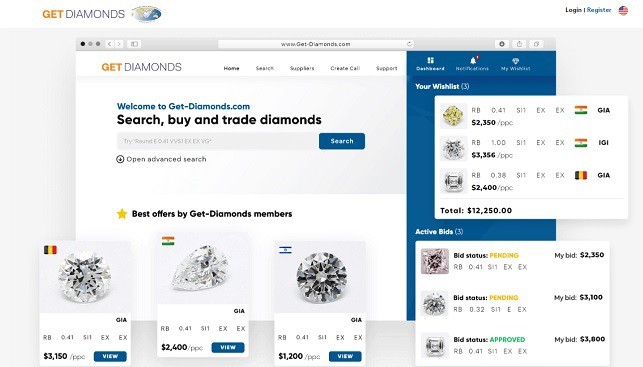

To provide an industry alternative, the WFDB acquired the Get Diamonds platform in early April and is transforming it into a non-profit organisation.

According to Dvash, in just three weeks of operation, the platform amassed US$3.5 billion worth of goods and almost a million stones. “The market is currently quiet but once activity resumes, Get Diamonds should see lots of transactions because it has the goods people need. This platform is an industry-driven initiative for the industry,” he said.

Get Diamonds’ board will comprise four presidents of WFDB member bourses, four diamantaires from the four biggest centres and four non-jewellery industry executives for a truly independent and transparent perspective, he continued.

Meanwhile, the Fancy Color Research Foundation refrained from publishing the Fancy Color Diamond Index for the first quarter of 2020, as virus-led disruptions made it difficult to establish accurate market pricing for most categories.

Way forward

Despite current challenges, 2020 may still produce some gains for the diamond industry, according to Dvash. He remains hopeful of an upturn, albeit slight, toward year-end, if not by mid-2020.

“It is too early to write off the entire year. Millions of weddings around the world were postponed or cancelled due to the outbreak. Once the virus is contained, there could be a resurgence of demand. We may salvage some business, especially with activity resuming in some markets,” he continued.

Stirrings in the Far East buoy Dvash’s cautious optimism. Around 33 per cent of Israel’s polished diamond exports head to Hong Kong and China. Their reopening could help counter the shortfall from Israel’s other major market, the US, for whom recovery is not yet in sight.

Coronavirus-induced business adjustments are however here to stay, the WFDB and IDE official noted.

“The pandemic amplified new realities and forced us to think out of the box. Online channels were viewed as a supplementary platform; now we see they can actually support and drive trade. Businesses can run on leaner, efficient operations, eliminating the need for big offices, high rents and overheads. Things will be different in the post-pandemic world,” Dvash said.

The Diamond Producers Association (DPA) is taking part too in the industry recovery effort. Working with local organisations, it has formed the Jeweler Support Networks in the US and the UK. These offer resources such as government advisories and free access to educational platforms to guide jewellers through the challenges of running their businesses during lockdowns.

“Local jewellery stores and retailers, many of which are family-owned for generations and comprise a large and important aspect of the industry, are particularly vulnerable during this crisis. We want to minimise the disruption caused by Covid-19 and ensure that when the world is ready to reopen, retailers are too,” remarked DPA Head of Marketing and Communications UK Lisa Levinson.

GEMSTONES

The Covid-19 global pandemic did not leave the coloured gemstone sector unscathed either, recording extreme and far-reaching effects across the entire supply chain.

Coloured gemstone miner Gemfields deferred its high-quality emerald and mixed-quality ruby auctions, originally scheduled for May and June respectively, to the last quarter of 2020 due to travel restrictions to contain the spread of the coronavirus virus. In 2019, around 93 per cent of the company’s revenues came from the gemstone auctions.

In comments on the company’s April 6 announcement of its 2019 results, CEO Sean Gilbertson cited the impact of the Covid-19 outbreak as one of the biggest challenges Gemfields has faced to date, saying it would clearly have a significant effect on many of its downstream clients and on end-consumers. “Given this delay in auction revenue, we have suspended all discretionary and uncommitted spending to preserve cash. Gemfields is highly dependent on revenue from gemstone auctions and any further delay in the 2020 auctions would put a severe strain on the Group’s finances,” he said.

On the manufacturing and export fronts, the widespread closure of borders, the cancellation of many international flights, and the postponement of major international trade fairs have resulted in reduced capacity to source, market and supply materials, according to Clement Sabbagh, president of the International Colored Gemstone Association (ICA).

Moreover, the detrimental economic repercussions in most markets have curtailed consumer demand for the coloured gemstone sector’s luxury products, he said.

Given the situation, ICA is arming its members and the wider gem and jewellery community with information to endure the current challenging business conditions.

“A rising number of small gemstone businesses are also reinventing, exploring and increasing their digital presence as a means to secure and maintain relationships with clients. We believe this trend will continue long past the pandemic and may redefine the business,” Sabbagh shared.

The global spread of the Covid-19 virus will indeed fundamentally change the industry and bring online transactions to the fore, remarked Anthony Brooke, vice president of the Thai Gem & Jewellery Traders Association.

Demand patterns may also undergo massive shifts, shaped by low consumer sentiment stemming from virus-induced lockdowns.

“Will low-cost items sell as people cheer themselves up? Will others want to buy gold jewellery as a hedge against further financial disruption? Will the whole market simply go into hibernation for six months? We don’t know yet,” Brooke said. “But once a vaccine is found and consumer confidence is restored, there may be major opportunities for companies to lead the way with new invigorating designs and bright colours to improve everyone’s mood.”

As demand is directly related to the purchasing power of consumers, recovery may take a while, according to ICA’s Sabbagh. This particular crisis will however leave its mark on the industry. “There certainly will be shifts in the market, in trends, and in the way business is conducted, all of which will be influenced by the new digital connection that companies are now discovering,” he said.

PEARLS

Pearl traders were not spared either from the onslaught of the coronavirus pandemic. According to Yoshihiro Shimizu, chairman of the Japan Pearl Exporters’ Association, sales have so far dropped between 20 per cent and 50 per cent, with major retailers such as Mikimoto and Tasaki closing its stores.

The cancellation or postponement of international jewellery fairs as well as pearl auctions also dealt a heavy blow to the pearl trade. Japanese pearl dealers who participate in various trade exhibitions source about 50 per cent of their annual sales from buyers they meet at the shows, revealed Shimizu.

With travel restrictions in place, Japan’s tourism industry likewise took a hit, seriously impacting pearl jewellery retailers who rely on foreign buyers.

Pearl companies also cannot strictly enforce work-from-home policies since they deal in a special merchandise that’s difficult to sell online. A few local customers however travel to these companies’ offices to purchase commercial- to better-quality pearls in smaller quantities at reasonable prices, noted Shimizu.

“The situation remains very challenging not only for the pearl sector but the entire jewellery industry. All we can do right now is wait and see how this all pans out,” he remarked. “There’s so much uncertainty that it’s hard to plot our next move.”

Jonathan Cheng, director of Hong Kong-based Rio Pearl, echoed this sentiment, noting that there’s virtually no activity in the pearl sector since buyers are hesitant to purchase goods that they may have to hold on to indefinitely.

“Business is completely at a standstill,” stated Cheng. “People might not buy anything even with a 40 per cent discount.”

Important markets such as the US have also shut down, effectively crippling manufacturing, retail and export industries. According to Cheng, majority of pearl dealers need to move volume so selling online is not a popular option.

There could however be a glimmer of hope once China resumes its economic activities but since the jewellery sector is not exactly China-focused, this opportunity would depend on how well positioned companies are to do business with China.

Hong Kong too is in a peculiar spot. While a post-pandemic scenario could offer a semblance of normalcy and a time to rebuild for some countries, political protests – which gripped the city for months and impaired many businesses – remain a risk that Hong Kong faces.

JEWELLERY

With customers staying away from shopping malls and shunning luxury spending, jewellery retailers are bearing the brunt of the Covid-19 crisis.

Hong Kong’s jewellery retail giants registered massive losses in the three months ending March 31, owing to store closures and lacklustre sales. Chow Tai Fook Jewellery Group Ltd’s sales were down 65 per cent in Hong Kong and Macau, and 41 per cent in China during the period in review.

Luk Fook Holdings (International) Ltd’s sales meanwhile plummeted 57 per cent, with Hong Kong and Macau recording an overall drop of 60 per cent. Sales in China saw a decline of 41 per cent.

Business in China however has improved in the first two weeks of April on the back of the gradual recovery of industrial, consumption and investment activities, according to Lukfook.

DFHK’s Lawrence Ma, who is also CEO of Lee Heng Diamond Group, agreed, noting that even Hong Kong seemed to be heading to a path of recovery, with fewer new cases of Covid-19 being recorded.

However, it would take two to three months before businesses can get back to “even 80 per cent” of their normal operations, continued Ma.

The difficulties faced by retailers similarly trickle down to the wholesale and manufacturing sectors since with weak sales, no one is expected to restock goods anytime soon.

“Perhaps the only good thing is that retailers have not been replenishing in the last three or four months, so with financial support and fiscal initiatives that the government is putting into the system, hopefully things will turn for the better by August or September,” revealed Ma.

Ken Lo, director of Eternity Mfg Ltd and president of the Hong Kong Jewellery & Jade Manufacturers Association, said producers were still processing some orders at the beginning of the year until the situation in the US and Europe worsened and shipments were put on hold or cancelled. “We initially thought that the situation was likely to improve by May but Covid-19 spreading in the west was highly unpredictable,” explained Lo.

The retail sector, on the other hand, was already dealing with losses pre-coronavirus, brought about by the social unrest in Hong Kong since June 2019.

According to Lo, companies are cutting costs and negotiating reduced rental fees with landlords to help cushion the virus’s impact on their operations. Jewellers continue to get in touch with their customers to retain engagement by phone call or email but have yet to receive client enquiries.

Turkey, for its part, recorded a whopping 85 per cent dip in jewellery exports since the beginning of March, according to Sirzat Akbulak of the Turkish Jewellery Exporters’ Association (JTR).

The country’s biggest overseas markets for jewellery are the Middle East, Hong Kong and the US. Turkish jewellery exports reached US$4.1 billion in 2019.

According to Akbulak, Turkish jewellery manufacturers have since stopped operations while trying to keep their businesses afloat and avoid retrenching staff. But with no international demand, Turkey’s jewellery export sector remains far from recovery.

The virus is also laying waste to Thailand’s jewellery manufacturing and export industry, revealed Suttipong Damrongsakul, chairman of the ASEAN Gems and Jewellery Trade Association.

The US and Europe are among its top-performing overseas markets, accounting for 25 per cent to 30 per cent of Thailand’s gemstone and jewellery exports.

Local companies face a cash flow crisis since they are unable to ship finished jewellery goods to other countries. There are no new orders, owing to jewellery store closures and subdued consumer demand.

Despite various cost-cutting measures such as reduced working hours and employee pay cuts, companies may have to tighten their belts further in the next two to three months by downsizing production and considering outsourcing and subcontracting to meet any orders.

Commenting on changes in their customers’ buying habits, Damrongsakul said consumers are cutting back on luxury items and instead buying necessities. They are however likely to gravitate towards jewellery items in trendy designs at more affordable prices.

Amid these unprecedented shifts in the global gemstone and jewellery landscape, more and more people are buying goods and services online, he continued.

Online strategies

Challenges arising from the pandemic shone the light on digital platforms and initiatives as an important business tool, according to Zulu Ghevriya, managing director of Hong Kong-based Prism Group.

With reduced operations, the company relied heavily on digital activities, including online meetings with Prism teams and clients through Zoom and other tools while focusing on its B2C online business.

Prism uses its website to drive sales alongside other social media platforms to keep its consumers informed. These channels offer a new experience and a different method to run businesses, noted Ghevriya.

“The world will move towards digitalisation, with more buyers understanding this platform. The pandemic has forced people to work digitally and I think they will get maximum benefits out of it,” he continued.

As such, Prism intends to sustain its online-driven strategies even after the threat of the virus subsides.

Milan Chokshi of India’s Moksh Jewellery likewise underscored the importance of finding new ways to do business.

“Improving the e-commerce segment of our business is a major change for us. We already wanted to do this, but the health and economic crisis only made it more urgent,” noted Chokshi.

The company is currently focusing on digital and social media channels. Its Instagram account has seen a heightened level of engagement throughout the outbreak, he continued.

Post-Covid-19, Chokshi said he expects a huge shift from heavy-traffic retail locations to “neighbourhood stores.” Buyers would likely support provenance-based brands as well as unique jewellery pieces that resonate with their lifestyle, with minimalism rising as a trend.

Akbulak of JTR meanwhile highlighted the value of continued education amid these very taxing times. The association is planning a series of online education programmes and webinars aimed at advising its members on how to handle the crisis and using international marketing tactics to sustain customer engagement. It will also offer potential strategies that can be employed by companies post-coronavirus. These events will be promoted through JTR’s social media accounts.

Aftershocks and resolutions

DFHK’s Ma said the coronavirus pandemic will result in adjustments in the jewellery business landscape. For instance, retailers may want to shorten their supply chains and replenishment cycles so they can respond faster to challenges. The industry should also consider whether diamond and jewellery manufacturers can support these changes.

Commenting on reports that consumer demand is slowly picking up in China, with customers resuming luxury spending after lockdown measures were relaxed, Ma said such knee-jerk reactions may not be sustainable.

“Sustainability will only come from economic growth. If people feel good, luxury products will see sustained recovery. Nothing can beat liquidity. With central banks putting liquidity into the system and interest rates falling, we will hopefully be a bit more optimistic by August and September,” he stated.

Over the next six to nine months, people may also not be too keen on travelling, which means these travel or vacation funds may be rechannelled to the retail sector, stated Armil Sammoon, chairman of Sri Lanka’s Sapphire Capital Group.

An altered consumer mindset is likewise expected. “Those who don’t purchase items online would be more comfortable buying goods on e-commerce sites. We could see the rise of a new group of online shoppers,” said Sammoon.

Prism’s Ghevriya meanwhile said there will also be changes in the way consumers view luxury products. Buyers are likely to favour original designs that carry compelling stories. Consumers will also be more connected to the meaning of buying jewellery.

“They need to see the value of the product since they want to save money and spend on experience. Price-point items will be highly sought after, which could affect the design,” he explained. “Consumers will probably demand sustainability from brands too.”

Thailand’s Damrongsakul meanwhile expects the gemstone and jewellery sector, particularly the high-end jewellery segment, to contract over the next five years. Big-ticket items may still attract consumer interest during special occasions such as weddings, and New Year and Christmas holidays.

In this scenario, consumers may opt for reasonably priced costume jewellery in trendy and attractive designs. Online marketing will also play a more significant role as businesses turn to digital and social media channels to reach their target clients.

To sustain growth, OEM players in Thailand should eventually transition to ODM business, produce their own jewellery designs and develop their branding strategies. This could result in more sustainable operations.

Thai jewellers should also focus on boosting sales in the domestic market, as well as China and Southeast Asia, and reduce their dependence on the US and Europe.

SOCIAL RESPONSIBILITY EFFORTS IN THE FIGHT AGAINST COVID-19

- De Beers Group contributed US$5 million across Botswana, Namibia and South Africa to aid response to the Covid-19 crisis.

- Chow Tai Fook Jewellery Group Ltd began manufacturing surgical masks using its high-standard dust-free cleanroom technology at its T MARK diamond processing factory in Lunjiao, Shunde.

- French luxury conglomerate LVMH Moët Hennessy Louis Vuitton SE repurposed its Perfumes & Cosmetics laboratories to manufacture hand sanitisers.

- Bulgari started manufacturing hand sanitisers. The jeweller also gave monetary aid to Lazzaro Spallanzani Hospital in Rome to acquire a modern, high-definition 3D microscope to help study coronavirus infections.

- Surat-based STPL developed a ventilator, IndoVent, aimed at boosting efforts to combat the Covid-19 pandemic.

- India’s Gem & Jewellery Export Promotion Council or GJEPC shelled out Rs 50 crores (around US$6.62 million) to assist daily wage workers in the country’s gemstone and jewellery industry.

- Luxury group Kering donated US$1 million to the CDC Foundation.

- In the US, Chanel has committed US$2 million to support urgent medical and healthcare needs.

This article first appeared in the JNA May/June 2020 issue.