The De Beers Group has announced that De Beers Canada has signed an agreement to acquire 100% “of the outstanding securities of Peregrine Diamonds”, which owns the Chidliak diamond mine in Canada’s Nunavut Territory. The purchase price totals C$0.24 per share for a total cash consideration of approximately C$107 million (around US$ 81,322,675).

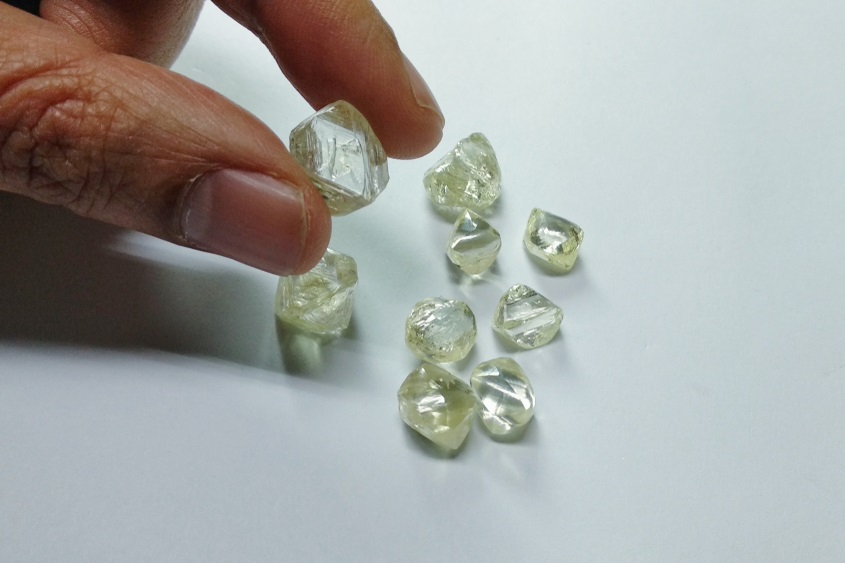

Chidliak was discovered in 2008 and comprises of 74 kimberlite identified to date. The mine’s main focus is on the CH-6 and CH-7 pipes, which contain more than 22 million carats. According to De Beers, the CH-6 deposit has a diamond valuation of US$151 per carat, making it “one of the most attractive undeveloped diamond resources in Canada”.

Bruce Cleaver, CEO of De Beers Group, said: “The Chidliak resource holds significant development potential and will be an exciting addition to our portfolio […]”. Eric Friedland, Founder and Executive Chairman of Peregrine Diamonds, said that the transaction “is the next step in the development of the Chidliak diamond project […] all stakeholders will benefit from this transaction and the involvement of De Beers as Chidliak advances toward development”. The deal is expected to be completed in September.