Ratings agency Standard and Poor’s (S&P) has given Anglo American, owner of diamond miner De Beers, a stable outlook. S&P raised the company’s long and short-term corporate credit ratings to BBB-/A-3 from BB+/B, as well as its long-term South Africa national scale rating to zaAAA from zaAA+, according to Mining Weekly.

S&P’ said in a statement: “Based on Anglo’s capital expenditure guidance for the coming years, and our view that the company will stick with the base dividend pay-out in the coming 12 months, we expect the company will allocate the excess cash to further reduce reported net debt to about $6-billion by the end of 2018”. Additionally, the agency said it considered Anglo’s business risk profile as “satisfactory”.

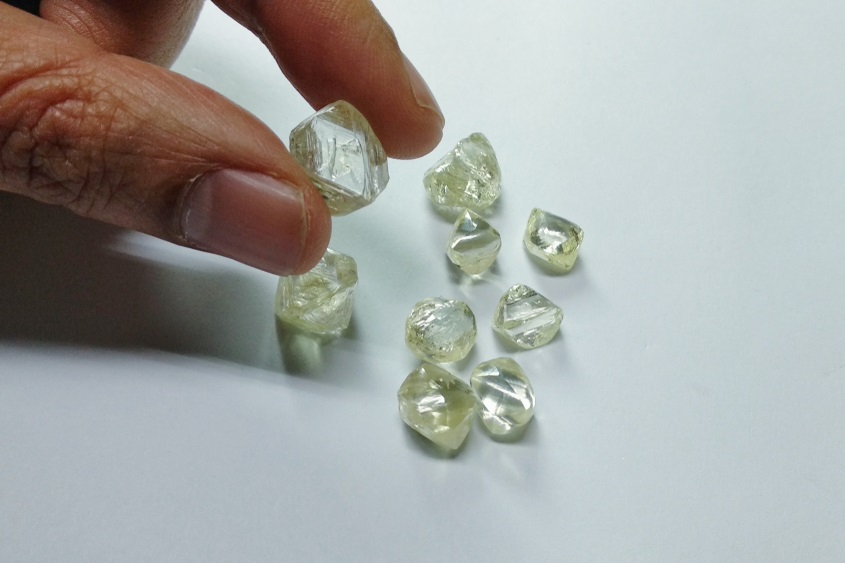

Earlier this month, De Beers reported that its sixth sales cycle of 2017 raked in $572 million in rough diamond sales, maintaining “the trend of consistently good demand for De Beers rough diamonds across the product range”. In July it was reported that De Beers produced 16.1 million carats in the first half of 2017, a 21% increase year-on-year. Revenue for the first half of the year declined 4% to $3.1 billion.