In a recent article called “Production Value Plunges, China Caves, and Manufacturers Focus”, Edahn Golan looks at the latest figures released by the Kimberley Process (KP) for 2016, and analyses the trends revealed in the numbers. Here are some major takes from his analysis.

Short-Term Contrasting Movement

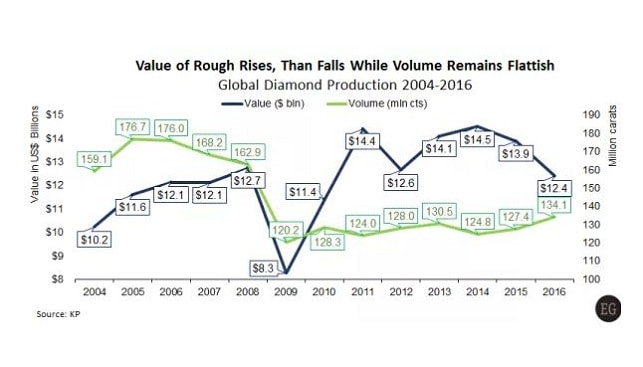

First of all, Golan notes, there is a contrasting movement of volume and value: while production in 2016 totaled 134 million carats, a 5.2% year-over-year increase, the average value of production plunged 15.1% to $92.49 per carat. This contrasting movement, he claims, is “not a good outcome for diamond miners” but it is a “movement in the right direction as far as manufacturers are concerned” as “diamond polishers in general would like to have more rough at a lower cost”.

Additionally, while diamond production volume has declined over the years by an average of 1% a year, the average P/C value has risen by 4.1% every single year.

Long-Term Trends: Volume Slides, Value Rises

Tracking rough diamond production and cross-border movement since 2004, one thing stands out: the value of global production fluctuates much more than its volume. While production volume has been fairly steady, especially since 2009, the average year-over-year change in total production value averages 3.3%, and the average year-over-year change in value per carat is 4.1%.

Production Trends

According to Golan, as rough diamond prices are inching up, an increase in total value is possible too. However, most of the mined goods “are smaller, lower value diamonds, and the price of many of them is not rising”.

Import Trends

“Unless the industry miraculously makes a turnaround and starts cranking out more polished diamonds at a decent margin, further consolidation is expected”, Golan writes.

Polished and Consumer Demand

It will be a struggle, Golan writes to improve polished diamond sales in 2017. He adds that much of the year’s outcome hinges on fourth quarter demand, which has been shifty in the past decade. Finally, “there is a dire need for marketing, and the DPA’s enlarged budget of $58 million is an important step in the right direction”.