In a recent article, “Lab-created Diamonds: Where to Go from Here”, diamond analyst Paul Zimnisky, analyses the fast development of synthetic, or man-made diamonds.

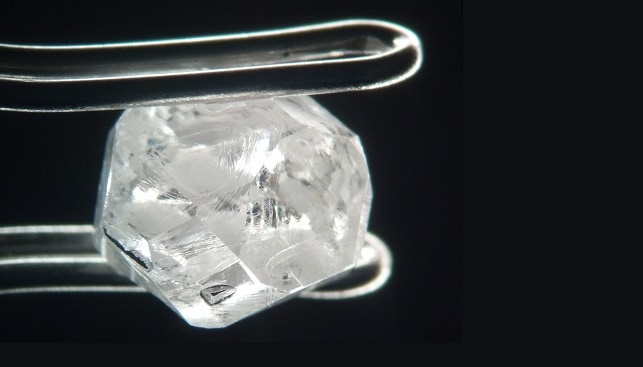

Zimnisky begins by explaining that, though the technology of lab-made diamonds has existed since the 1950s, the first engagement-ring-quality equivalent hit the market only about five years ago. In recent years, he says, companies have invested “an unprecedented amount of capital” in advancing lab-created diamond production technology.

The success or failure of lab-created diamond jewelry, he claims, is dependent on several factors: branding and marketing, production economics, consumer perception of value, and underlying secular demand for diamond jewelry.

Branding and Marketing

Many consumers, Zimnisky says, still confuse lab-created diamonds with diamond simulants like moissanite, cubic zirconia and white sapphire”.

The lab-created diamond industry, he says, can take advantage of two factors: the ethical sourcing of the stones, as well as unique branding for a younger, “high-tech” demographic.

Production Economics

The lab-created industry’s primarily edge over the natural equivalent, Zimnisky says, is pricing. Currently, lab-created production is greatly focused on smaller, lower-quality stones, which trade “at significant discount to naturals”. However, most stones in popular bridal-sizes are currently selling for about a 15-20% discount to natural equivalents – meaning that the relative discount is still far from that of other lab-created gems, such as lab-created rubies, emeralds, and sapphires.

Consumer Perception of Value

Perhaps the biggest challenge for the lab-created industry is selling a diamond that “arguably lacks resale value”, Zimnisky claims. The supply of lab-created stones is theoretically unlimited and in Asian cultures in particular, “the perceived intrinsic value of jewelry is perhaps the most significant component of the purchase decision”.

Since China and India being the two fastest-growing diamond jewelry markets, the lack of intrinsic value of lab-created diamonds could be “a particularly challenging factor for the industry”.

Secular Demand for Diamond Jewelry

In recent years diamond demand growth has been affected by declining marriage rates and by younger generation’s “growing preference for discretionary spending on experiences over material possessions”.

The lab-created diamond industry, Zimnisky says, can capitalize on these trends “by selling the idea that a lower priced alternative to natural diamonds allows for owning a diamond while still leaving discretionary spending for experienced-based purchases”.