In a recent analysis titled “Jewelry Demand Sinks 11% in October, But Do Not Fret!” on Edahn Golan Diamond Research & Data, diamond analyst Edahn Golan analyzes the latest sales figures and market trends.

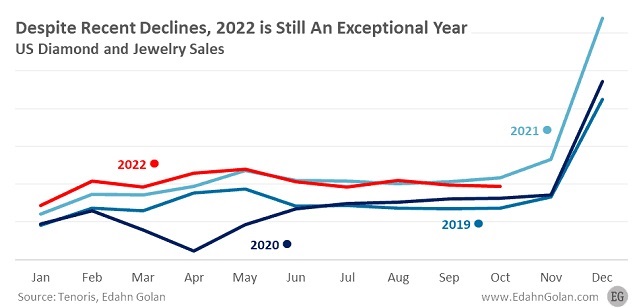

He begins by stressing that, while “most jewelry retail sales figures were in the red in October on a year-over-year basis, […], US jewelry demand is still relatively high, reflecting ongoing elevated consumer interest in the category.” Compared to the pre-pandemic levels of 2019, sales in 2022 “outperformed 2019 every single month.”

Jewelry Demand and Trends

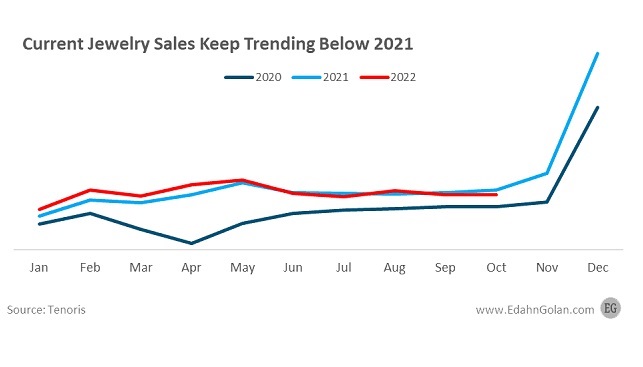

In terms of value, jewelry sales fell 11.1% in October, while the number of units sold fell 12% year-over-year. Over the ten-month period (January to October 2022), jewelry demand rose 4% year-over-year.

Year to date, the average per unit spend increased 9.3% year-over-year. In terms of volume (counted by the number of units sold), jewelry sales fell 5.2% year-over-year in the January-October 2022 period.

According to Golan, “the two most important jewelry market trends so far this year were chain necklaces and fashion rings.” Chains captured a 13.7% market share of units sold in the first ten months of the year, and were also the best-selling item in October.

Fashion rings were the best performing item in terms of revenue, generating 13.5% of total jewelry sales during the period.

As for the sales of natural diamonds, year-to-date sales were down 5.2%, “falling 25.4% year-over-year in October alone.” Retailers lowered diamond prices, evident in a 1.1% decline in the average price of round, 1-carat diamonds during the period.

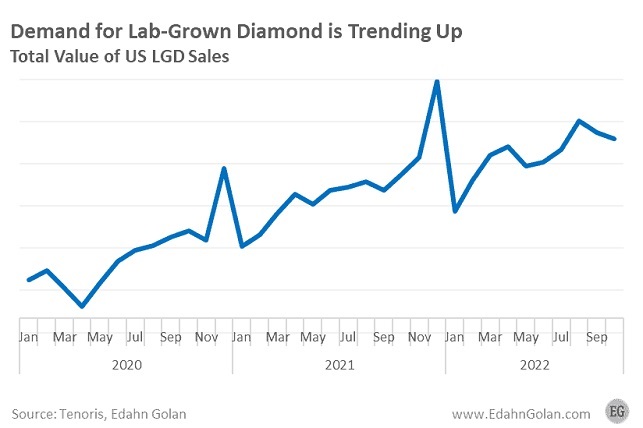

For lab-grown diamonds, Golan identified two key trends in October: “prices continued declining, and sales kept rising.” LGD sales went up 41.8% year-over-year in October, while prices were down on average 4.4%. Year to date, lab-grown diamond sales were up more than 37%.

Golan then goes on to discuss several more issues: changes in inventory in response to changing demand; jewelry demand in 2022 vs. 2019; and the forces impacting holiday jewelry sales – “the increased interest in jewelry, the positive impact the midterm election results have had on the mood of large city consumers, and the high cost of international travel.”

Read the full article here