Bank Igud (Union Bank), the primary financing source for the Israeli diamond industry, has announced a merger between Bank Mizrahi-Tefahot and Bank Igud. Mizrahi-Tefahot will purchase Bank Igud for 1.4 billion NIS through the allocation of Mizrahi-Tefahot shares to Bank Igud shareholders.

Mizrahi-Tefahot is the third largest bank in the country, while Igud is the sixth largest. Once the merger is completed, the Israeli banking system will comprise of seven local banks.

The merger agreement is dependent upon several factors: Bank Igud’s agreement to efficiency measures, regulatory approval by Bank of Israel and the Antitrust Authority, as well as approval of the deal by Igud shareholders.

Bank Igud was established in 1951. Between 1983 and 1993, it was owned by the government and Bank Leumi. In 1993, ownership was transferred to three individual entities: Shlomo Eliahu Holdings, Yeshayahu Landau Holdings and David Lubinsky.

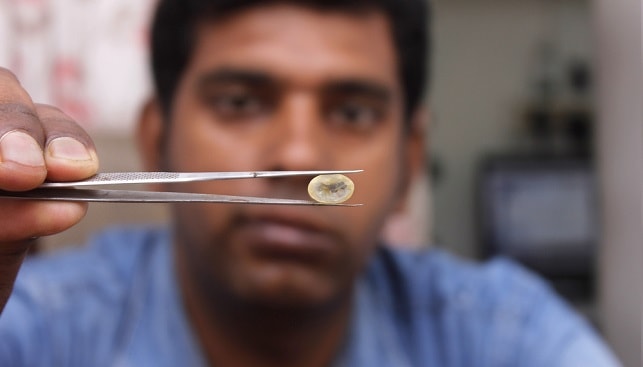

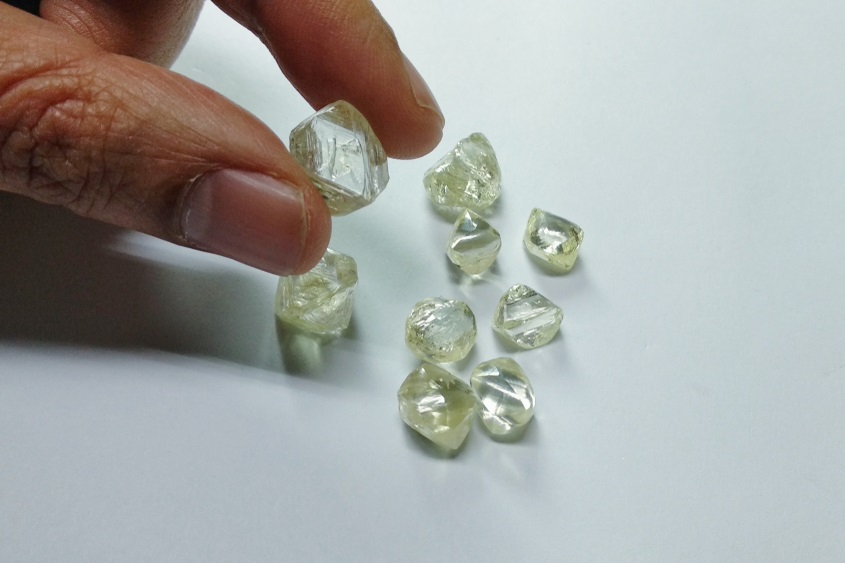

Bank Igud has a long standing relationship with the diamond industry. The country’s first diamond bourse was located at the bank’s HQ in Tel Aviv. Today, the bank holds a branch in the Shimshon building at the bourse complex in Ramat Gan. Bank Igud’s diamond portfolio is estimated at $1 billion, while the bank’s credit portfolio for the industry totals $343 million, compared to the $280 million held by Mizrahi-Tefahot. Recently, it was reported that Bank Igud is promoting the transfer of its diamond and mortgage portfolios to other institutions.

Written by Iris Hortman