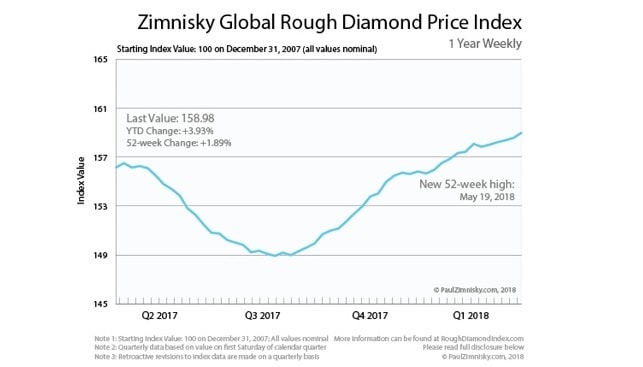

In a recent article, Why Rough Diamond Prices are at a 52-week High, diamond analyst Paul Zimnisky explains how and why the current environment in the industry favors “higher diamond prices over a period of at least the next four years”.

Past Trends

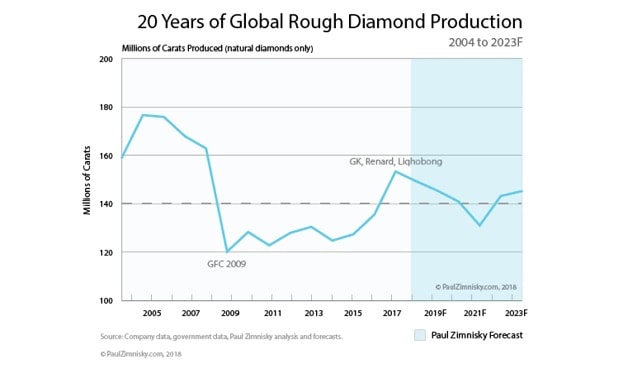

Diamonds were one of the fastest commodities to recover after the global financial crisis of 2007-2009, Zimnisky says. Their prices went up almost 150% from the low in early-2009 through mid-2011.

However, “since making an all-time high in Q2 2011”, diamond prices have gone down. The run-up in prices led to growth in incremental supply through 2017, but this was not met with commensurate demand. Among the reasons was China’s economic slowdown in 2015, and over-leveraging in the diamond industry’s manufacturing segment.

Current Trends

Today, Zimnisky explains, “forecasted industry fundamentals point to an environment favoring higher diamond prices over a period of at least the next four years”. In Q1, jewelry store sales in the US were up 11.9% year-over-year and in Mainland China “gold, silver and jewelry” retail sales were up 7.9%.

If conditions continue, and there are no major global economic disturbances disrupting consumer diamond demand, “incremental year-over-year diamond production declines are forecast to drive real diamond prices up approximately 10% cumulatively from 2018 through 2021”. Diamond prices could revert back to 2014 levels, which would be about 8% above today’s prices, Zimnisky claims. This, he says, is already supported by the current supply-demand dynamic as rough prices are up 3.9% year-to-date through mid-May – marking a 52-week high.

Risks of a continuation of this trend is a global economic slowdown, which could result from several factors, among them further U.S./China trade hostility, escalation of the U.S./Russia/Iran proxy war, consequences of the over-levered Chinese consumer economy and more.