The American jewelry market experienced a volatile year in 2024. While overall sales increased, significant sectors of the market recorded weaker performances. According to analyst Edahn Golan, natural diamonds lost some of their allure, but consumers who chose to buy them were willing to pay higher prices. Lab-grown diamonds (LGD) continued to gain traction, capturing 14% of the market share, even as their prices declined further.

U.S. Jewelry Sales Performance

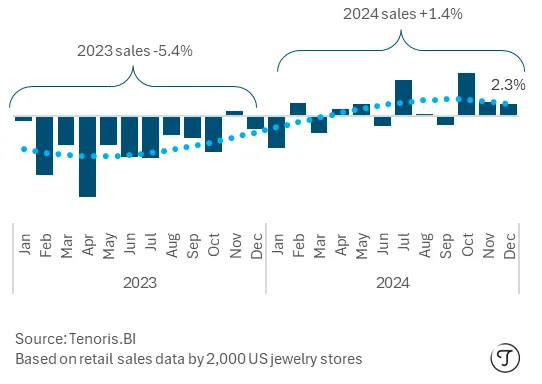

Total jewelry sales in the U.S. grew by 1.4% in 2024, though the number of units sold dropped by 1.6%. This modest performance was mainly attributed to decreased revenues in the natural diamond segment. As Golan’s analysis highlights, retailers have consistently increased their gross profit margins, which reached an average of 49.6% last year. Stable inventory levels compared to 2023 suggest that retailers are actively managing costs and reducing risks in an uncertain market.

Total US Jewelry Market Sales Rose 1.4% in 2024

Finished Jewelry: Positive Trends

The U.S. finished jewelry sector delivered encouraging results, with sales increasing by 2.9% in 2024. This rebound follows a 3.4% decline in 2023. Although the number of units sold decreased, the average price per item rose by 4.5%, reaching $1,090—the highest increase in five years. According to Golan, this price growth compensated for lower unit sales, contributing to the sector’s overall positive performance.

Natural Diamond-Set Finished Jewelry Revenue

Holiday Season Sales

The holiday season demonstrated strong sales momentum. From November to December, sales revenue rose by 3.7% despite a 3.2% drop in the number of units sold. During this period, finished diamond jewelry maintained its stability. The average price of diamond jewelry increased by 6%, reaching $1,956, reflecting consumers’ preference for larger diamonds in their purchases.

LGD Jewelry

Sales of finished LGD jewelry surged, with a 43% increase in the number of units sold and a 31% rise in total revenue. However, as noted in Golan’s report, this growth marked a slowdown compared to 2023. Prices for LGD jewelry continued to decline, with the average price dropping by 8.3% in 2024. This price trend underscores an ongoing shift in consumer expectations for affordability within this category.

Loose Diamonds: Persistent Price Pressure

Retailers faced challenges in both natural and LGD loose diamond segments. Total revenues from loose diamonds fell by 5% in 2024.

Natural Loose Diamonds

For the third consecutive year, natural loose diamond sales declined. Revenues dropped by 4.3%, and the number of units sold decreased by 6.2%. However, the average price per diamond rose by 2.1% to $10,104, driven by an increase in average diamond size—from 1.30 carats in 2023 to 1.39 carats last year. According to Golan, the rising demand for 2-carat diamonds partially offset declining sales volumes, as consumers took advantage of lower prices to purchase larger stones.

Loose LGD

The loose LGD segment faced contrasting trends. Revenues fell by 7.2%, while the number of units sold rose by 18.6%. This was largely due to a sharp 21.8% drop in average price, which stood at $2,443 per diamond. Retailers adapted to the ongoing price declines by increasing memo agreements and raising gross profit margins, which reached 70.9% by December 2024. During the holiday season, revenue from loose LGD decreased by 10%, while the number of units sold rose by 15.8%. The average retail price fell by 22.3% to $2,185, but gross profit margins soared to a record high of 70.8%.

Conclusion

Despite a challenging year, the U.S. jewelry market demonstrated resilience. Finished jewelry showed signs of recovery, and consumer preferences shifted toward higher-quality, larger diamonds. As per Golan’s analysis, the industry’s adaptation strategies—such as actively managing costs, optimizing inventory, and leveraging higher profit margins—are pivotal in navigating ongoing market dynamics.

Read the full analysis here