The board of directors at Anglo American has decisively turned down BHP Group’s unsolicited non-binding offer to acquire the company for $38.9 billion, citing its belief that the offer “significantly undervalues” Anglo American, Rough & Polished reports.

In a statement, Anglo American said: “In addition, the proposal contemplates a structure which the board believes is highly unattractive for Anglo American’s shareholders, given the uncertainty and complexity inherent in the proposal, and significant execution risks. The board has therefore unanimously rejected the proposal.”

The proposal from BHP, the world’s largest mining company, included an all-share offer and suggested separate demergers by Anglo American of its entire shareholdings in Anglo American Platinum (Amplats) and Kumba Iron Ore to Anglo American shareholders.

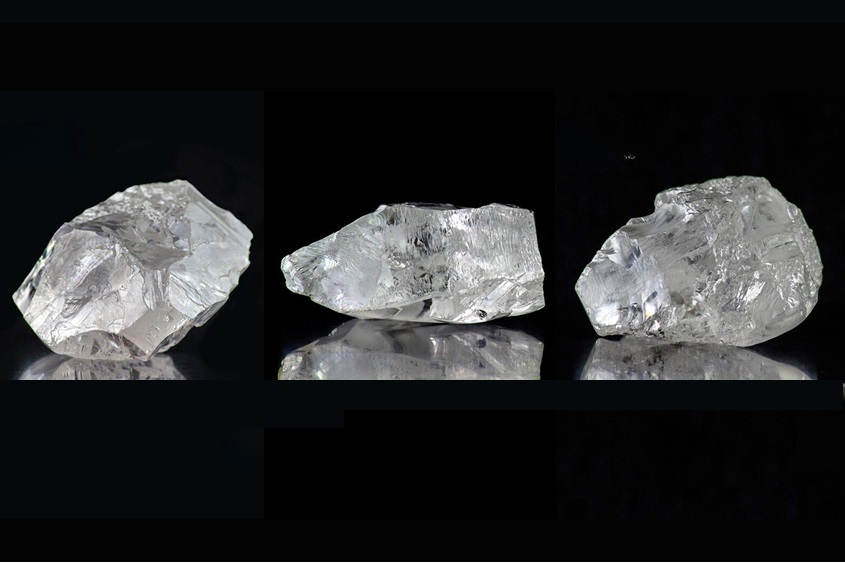

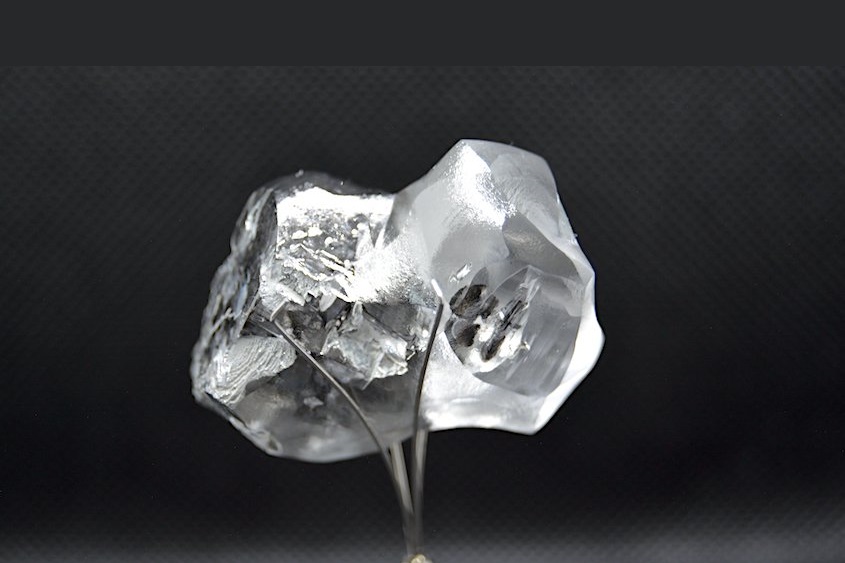

In related Anglo news, De Beers has slashed its production guidance for the year by 10%, IDEX Online reports. According to the Q1 2024 Production Report released by De Beers’ parent company Anglo American on April 23, De Beers expects a fall of around 3 million carats from its initial projection of 29 million to 32 million carats, revising it down to 26 million to 29 million carats.