A recent article written by diamond analyst Paul Zimnisky examines trends in the lab-grown diamond market, which has been steadily growing since 2018, while looking into four characteristics that could shape the man-made diamond jewelry industry: 1) limitless supply, 2) standard superior quality, 3) branding and proprietary design; and finally, 4) custom shapes and colors.

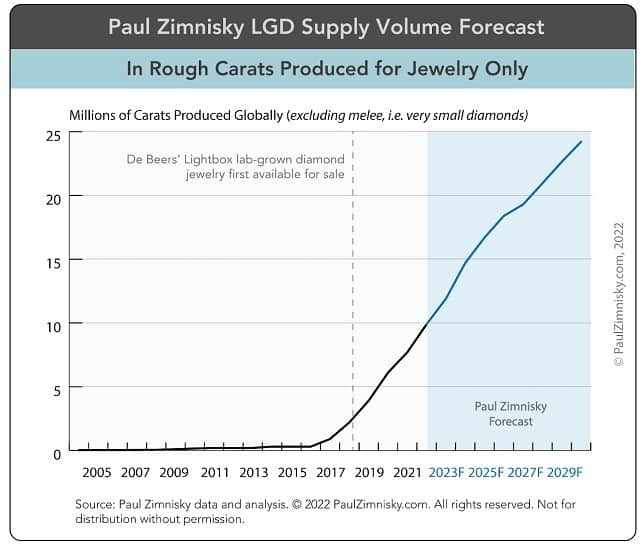

Zimnisky begins by showing that demand for LGDs has been steadily growing since 2018. While they represented less than 5% of global diamond jewelry sales in 2018, LGDs are expected to reach 10% in 2022, and will constitute 20% by the end of the decade if this pace of growth continues.

The next phase of growth, he says, “will likely bring upon a newfound level of maturity to the industry shaped” by the four characteristics mentioned above.

As to the first, limitless supply, since China is currently producing in excess of 10 billion carats of synthetic diamonds a year for use in abrasive applications — which compares to a hundred-million carats of natural diamond — the scalability potential for man-made diamonds for use in jewelry is enormous.

This only accounts for the potential supply from High Pressure High Temperature (HPHT) production, which represents about half of global man-made diamond supply used in jewelry. The other, newer production method, Chemical Vapor Deposition (CVD) diamond production, “is quickly growing, especially in India and again China”. CVD is estimated to represent the other half of global supply.

Regarding the second item – standard superior quality – as man-made diamond production technologies improve, so will the quality of production. Eventually, says Zimnisky, “almost all man-made diamonds will likely be of a universal-high-quality —which could render diamond grading of lab-diamonds non-necessary.”

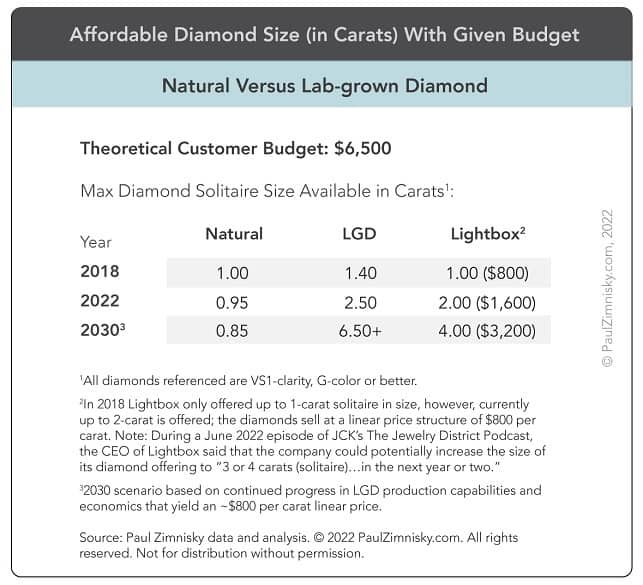

As to the third item – branding and proprietary design, Zimnisky explains that together with increasing demand for LGDs, relative prices have also steadily declined, probably due to increases in supply and the quality of supply. For example, while in mid-2018, a generic 1-carat VS1-clarity, G-color lab-diamond retailed for $3,625 while a natural equivalent retailed for $6,600. Today the same quality diamonds sell for $1,615 and $6,705, respectively. He goes oin to examine this feature in depth.

As to the final item – custom shapes and colors – in contrast to natural diamonds, manufacturing an “all-diamond” ring is possible. In addition, a custom cut or shape is possible, as is a diamond color that does not exist in nature. This gives the LGDs industry possibilities that the neutral diamond industry lacks.

Read the full article here.