According to sources quoted by Mining Weekly, De Beers told its diamond buyers that it would be doubling the size of its buyback process in the next sale. This, according to the report, is “the first sign the market is slowing after a bonanza that started during the global pandemic.”

While De Beers raised prices of rough diamonds throughout much of 2021 after sanctions on Alrosa forced buyers to seek supply from elsewhere, things have been gradually changing: Alrosa has started to sell diamonds again, Chinese demand has been hit by Covid-19 lockdowns, and the US and Europe are suffering from surging inflation.

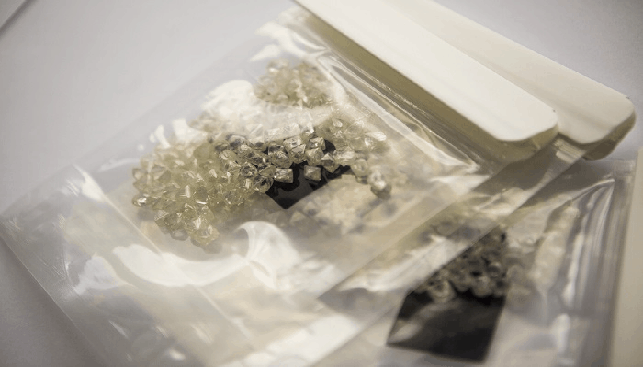

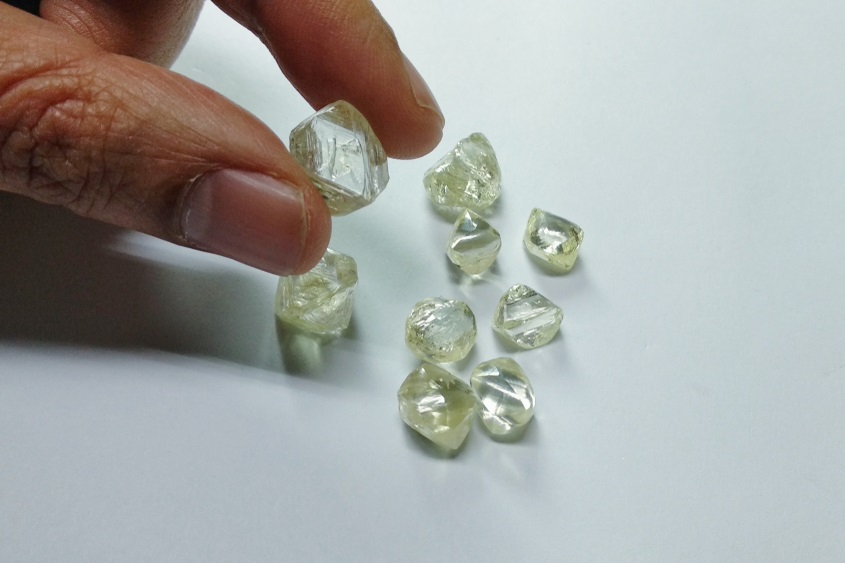

According to the report, De Beers told customers in a memo “that it would be doubling the size of its so-called buyback process.” According to the report, “the buyback system allows customers to handpick a percentage of the stones in any parcel and sell them back to De Beers.” In the memo, De Beers told customers that the buyback would be increased from 10% to 20% for diamonds bigger than 1 carat at its next sale (scheduled for the end of October).

This, according to the report, allows “De Beers to offer sweeter terms without having to cut prices […].”